|

by Ben Aris from IntelliNews Website

Having lived through the

1998 crisis when Russia's financial system was wiped out for the

want of a few billion dollars to meet the government's obligations,

there has been a strong "never again" meme that has run through the

Kremlin's financial policy.

During the boom years

Putin signed off on former finance minister Alexei Kudrin's

plan to ring fence several reserve funds that amazingly were kept

away from greedy oligarchs and profligate

Duma deputies.

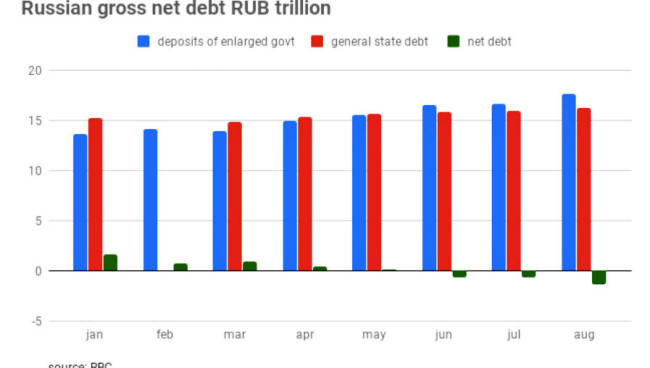

Public debt is the broadest definition of debt and includes the more narrowly defined external debt, as well as the domestic debts of the government, the regions and the municipalities.

As of August 1 the total state debt was RUB16.2 trillion ($248bn) or 15% of GDP and equivalent to what the government takes in each year in total as taxes.

The amount the state has in cash in deposits with the central bank was RUB17.6 trillion on the same date, or 16.2% of GDP.

Although oil prices are much lower than their boom years peak of some $150, Russia Inc is accumulating money quickly again as it has become a lot more profitable than it was in the nineties.

In the nineties

the breakeven price of oil for the budget was $115 per barrel

but now that has fallen to around $41, so while the prices are lower

Russia's profit margin is wider.

The volume of cash

currency and cash on deposits in the general government accounts in

2018 grew by a record RUB3.87 trillion, according to

Rosstat data on national accounts -

an all time record gain in a single year.

The austerity that comes with not leveraging up the country's economic potential and borrowing a bit more carries the price of slow growth, say analysts.

Russia could have

increased its total debt by half without threatening financial

stability and used the extra money to boost growth and end the

stagnation, according to analysts at

Sberbank CIB, but won't as long

as it is in a de facto economic war with the US.

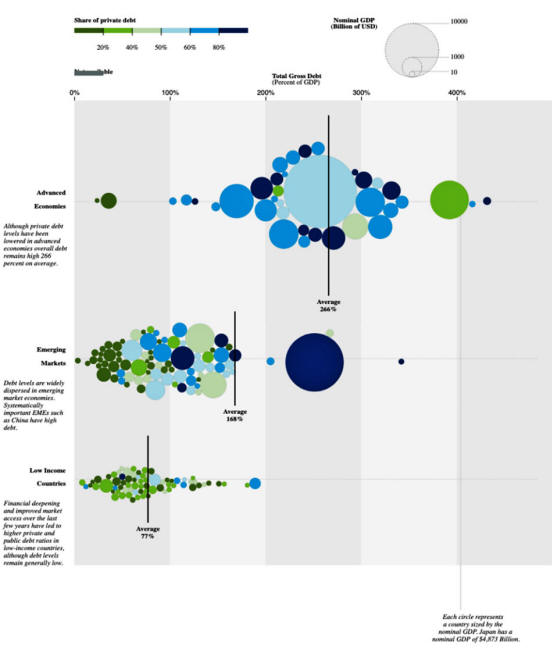

Most countries ran up

huge bills as they borrowed heavily to stave off recession following

the 2008 global financial crisis,

caused by the implosion of the US sub-prime mortgage market and its

mortgage backed securities.

Total global gross debt

topped $184bn at the end of 2017, or 225% of global GDP,

according to the IMF.

In Russia there is a mere

$900 of gross total debt per capita, or slightly more than the

equivalent of one month's salary.

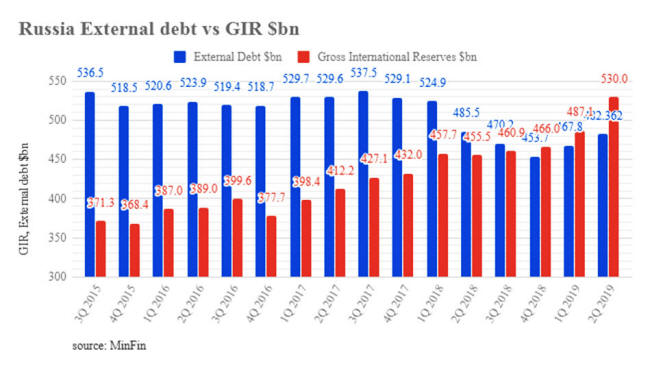

The difference is that while developed markets, with their sophisticated financial sectors, maintain only small international foreign exchange reserves, as they can finance imports using financial instruments, the emerging markets tend to keep at least three months of reserves on account as a buffer against external shocks.

In Russia's case

these reserves topped $500bn

earlier this year for the first time since the Crimean sanctions

were imposed, which is enough to pay for 13.5 months of imports -

vastly in excess of what economists believe is needed to ensure the

stability of the national currency.

As the below chart shows, all of the developed markets have significantly higher debt than the emerging markets, with Japan as the outlier with almost 400% of GDP of total debt.

|