by Benjamin Fulford

May 28, 2012

from

EClinik Website

Deutsch version

Italian

version

The final showdown in the ongoing financial war

is appearing imminent.

The 140 nation

BRICS alliance is preparing to

offer to buy up all cash US dollars and replace them with a new currency

backed by a basket of commodities, including precious metals, according to

multiple sources. After that move, any money printed by the US

Federal Reserve

Board crime syndicate would not be accepted as currency by the 140

nation group.

This would force an end game for the criminal

cabal that illegally seized power in the United States. Before that move,

though, there will be a 5-day bank holiday in Europe followed by the end of

the Euro and the re-introduction of old national currencies like the

Deutschemark and the Drachma,

Rothschild family sources say.

The situation, however, remains highly volatile and there are signs of

dangerous end-game maneuvers by the cabal.

In Japan, the attempt by the cabal controlled media to create panic over the

nuclear terrorism

at Fukushima, is being accompanied by

renewed threats of nuclear terror. The deep sea drilling ship

Chikyu Maru has been spotted off the shore

of the Rokkasho Mura nuclear complex in Aomori Prefecture Japan, according

to Japanese military intelligence.

The ship is crewed by Americans and brainwashed

Japanese slaves.

Rokkasho Mura is the location of a giant plutonium processing complex that

has already produced enough plutonium to manufacture 5000 nuclear weapons.

Sending the Chikyu Maru to drill tactical nuclear warheads into the seabed

off the shore of Rokkasho Mura is a cabal attempt to blackmail the planet

with a nuclear holocaust.

Shoichiro Kobayashi, adviser to Kansai Electric Power, and Yoshiyasu

Sato, adviser to Tokyo Electric Power and both members of the Rothschild

crime syndicate’s

Trilateral Commission will be taken in for

vigorous questioning about their knowledge of this renewed terror threat.

They are expected to sing like canaries and

point their fingers directly at the Rockefeller gangsters behind these

latest terror threats.

Message to

the Rockefeller family:

Remove David, David Junior, Nicholas and J.

from all responsibility and hand over control of the Rockefeller

syndicate to the female members of that family. If you do not, every

single descendant of John Rockefeller will be hunted down and eliminated

from all levels of existence forever.

While we are at it, we would also like to

kindly request that

the DuPont family remove all carcinogens

and infertility causing chemicals from their product lines in Japan and

elsewhere.

Sources in the Japanese underworld are also now reporting that the Inagawa

Kai and Yamaguchi Gumi yakuza gangs are split between those who are still

working for the

Committee of 300 and those who want to

restore Japanese independence.

The talk is that top Committee of 300 traitor

slaves Yasuhiro Nakasone and Junichiro Koizumi are headed for

punishment from heaven.

Question for Nakasone:

“What was in all those blue boxes your

people loaded into a submarine and sent to your North Korean homeland?”

Was it documentary evidence of your crimes or

were you sending Japanese plutonium to North Korea?

The other people on the crime list in Japan are Hisashi Owada from

the International Court of Justice and Eiji Katsu from the Ministry

of Finance. Owada’s daughter, Princess Masako, recently tried to poison the

Japanese Emperor, according to families inside the Royal Household Agency.

The Emperor recently returned from England where he discussed the White

Dragon Society, among other subjects, with the Queen. A representative of

the emperor asked for a meeting with a representative of the White Dragon

Society on May 26th, but the between was abruptly postponed by

the Emperor’s side. We do not know why.

We trust the Emperor and the Queen agreed to purge the Satanists from the

Committee of 300 and support a massive campaign to end poverty and stop

environmental destruction. Hand written letters will be delivered to both

parties requesting support for such a campaign and requesting their

voluntary appearance before a truth and reconciliation committee.

Returning to the situation in Europe, we notice most of the reporting about

the “financial crisis,” there leaves out the elephant in the living room,

i.e. the 140 nation BRICS alliance.

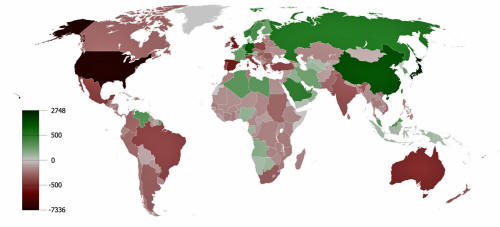

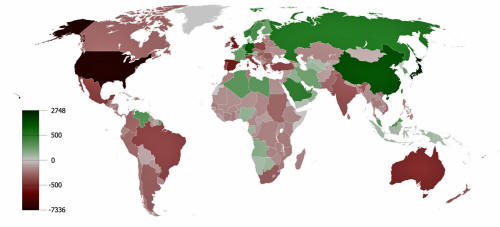

The link to the following map explains the real reason for the crisis:

Origin

Cumulative Current Account

Balance 1980–2008 (US$ Billions)

based on the

International Monetary Fund data

Basically, Europe has maxed out its credit card

with the rest of the world.

The region as a whole needs to negotiate a

restructuring of its debt to the rest of the world. The rest of the world is

asking for an end to ceaseless warmongering in return. The only European

country other than Germany that has enough money to solve the crisis without

reference of the rest of the world is Russia. Give Putin a call.

Canadian Finance Minister Jim Flaherty, the longest serving Finance

Minister in the G8 and a direct participant in the financial negotiations of

the past few years,

explains the situation very clearly.

Basically, he is saying the Europeans need to take their medicine just like

all other countries that went to the IMF for money in the past had to.

The

firing of the head of the Vatican bank last

week and the turmoil in

the Vatican are more signs of the end of an

era in Europe. The situation in the US is also coming to a head.

A very

senior US agency source asked that the following information be spread far

and wide:

President Obama’s social security number 042-68-4425 belonged to a

John

Paul Ludwig born in 1890. Obama’s grandmother, Madelyn Payne Dunham,

worked in a probate office in Hawaii where she had access to social security

numbers of deceased individuals.

Because Ludwig never received Social Security

Benefits, there were no benefits to stop, therefore no questions were ever

raised.

Dunham, knowing her grandson was not a US citizen, because he was born in

Kenya and became a citizen of Indonesia upon his adoption, she scoured the

probate records until she found someone who died who was not getting

benefits and selected Mr. Ludwig’s for Obama, the agency official explained.

Detailed, indictable criminal evidence against

Henry

Kissinger was also provided by sources in Indonesia.

Basically, Kissinger was involved in the murder

of 14,000 Indonesians in Papua New Guinea to facilitate gold mining by

Freeport, a company Kissinger advises. Kissinger gets $500,000 a year from

them as a board member and gets another $500,000 in consulting fees.

In any case once the corporate government of the US is put out of business,

the Renminbi will become the currency of the world.

The date given by two

insiders for this event is September 16th. We again remind readers that

many

dates have come and gone without predictions turning true so please remain

skeptical and only believe 100% when you actually see it happen.

However, it is true that China has been systematically buying up all natural

products like trees, copper, farmland or anything tangible to back a reality

based currency.

The Eurozone Should Sort Out...

Its Own Mess

by Jim Flaherty

May 3, 2012

from

DepartmentOfFinanceCanada Website

The International Monetary Fund

is not there to give special treatment to

Europe,

which is now endangering the world.

|

Jim Flaherty is Canada’s

minister of finance and the longest-serving finance minister in the

G7.

The following guest column by the

Honorable Jim Flaherty, Minister of Finance, first appeared in the

May 1 online edition of The Daily Telegraph.

In it, Minister Flaherty calls on

Eurozone nations to act quickly and decisively to address the

European debt crisis, and urges IMF resources to be used fairly. |

At the meeting of the

International Monetary Fund recently, Canada decided

against contributing more resources to support the Eurozone.

We also argued that all countries borrowing from

the IMF should be treated equally. We took these positions because we

believe they are in the best interests of the Eurozone, of the IMF, and of

the international community.

We have always supported the IMF’s important systemic role in promoting

economic stability by providing loans to countries that have exhausted their

domestic options, and placing these countries on a path to sustainability

through time-limited interventions. But it is not the IMF’s role to

substitute for national governments.

In order for any IMF action in Europe to be successful, a sense of direction

and a comprehensive blueprint to return to sustainability are necessary.

The question of sustainability cannot be

separated from that of the future of the European monetary union. As such,

its members should take the lead in defining a comprehensive and credible

blueprint.

This requires more than incrementalism and

wishful thinking.

Europe has taken important steps in this

direction with the fiscal compact, with economic and fiscal reforms in Italy

and Spain, with an enhanced firewall, and with the recent actions of the

European Central Bank to provide liquidity support. However, more is needed

to return the Eurozone to sustainability and to address the systemic

internal imbalances that threaten the monetary union.

Since 2008, and throughout the European debt crisis, I have been telling my

international counterparts that it is important to overwhelm the problem and

get ahead of the markets. This is what the United States did in 2008, and it

is what Canada did in 2009 by deploying a fiscal stimulus of roughly 4 per

cent of GDP over two years in response to a crisis originating outside our

borders.

These bold actions paid off.

Rating agencies

have reaffirmed Canada’s strong AAA credit rating, and we are now on track

to return to balanced budgets over the medium term. By contrast, actions

taken by the Eurozone have fallen short of overwhelming the problem.

The “muddle through” approach has led to an

erosion of confidence in public leadership and too many missed

opportunities.

Ultimately, the adequacy of the actions taken will be judged by the markets.

Repeated expressions of confidence by politicians are futile if the markets

continue to cast their vote of non-confidence. The markets’ confidence in

political leadership will only be restored when it is clear that politicians

are willing to see the full scope of the problem, to focus on the key issues

instead of pursuing sideshows such as the financial transactions tax, and to

set out and implement a plan for tackling these issues.

The European debt crisis also raises a question of resources. The Eurozone

has sufficient resources to tackle its sovereign debt crisis, but there is

an unwillingness to commit them to tackle the problem. In these

circumstances, IMF loans are not an adequate substitute for a serious

commitment by Eurozone countries to resolve this crisis.

We cannot avoid the question of fairness. Eurozone members benefit from

increased exports and price stability. Spreading the risks of the Eurozone

around the world, while its benefits accrue primarily to its members, is not

the way to resolve this crisis. We cannot expect non-European countries,

whose citizens in many cases have a much lower standard of living, to save

the Eurozone.

Further, the IMF, with roughly $400 billion,

already has adequate resources to deal with imminent needs.

The manner in which the IMF provides support must also be fair. It has been

very successful at resolving crises using its trusted model of time-limited

lending agreements, with strict conditions imposed on the borrowing country.

This is why I believe that all countries

borrowing from the IMF should be treated the same. Canada’s position is that

conditionality should be determined exclusively by the IMF, and not by the

“Troika” of the IMF plus the European Central Bank and the European

Commission.

If the Eurozone is seeking assistance, it should

not be setting the terms under which this assistance is provided.

Further, Europe controls 34 per cent of votes at the IMF. In that context,

the simple majority required for the fund to make an investment is a

relatively low threshold. Emerging markets play an increasingly important

role in global economic issues. Canada has been a leader in recognizing

changing international dynamics and advocating greater representation of

emerging markets at the IMF.

In this context, we believe that measures should

be taken to ensure that major decisions about resources dedicated to Europe

require more than a simple majority.

Canada believes in the Eurozone’s ability to solve this crisis. We also

believe in a strong and fair IMF where emerging economies can take their

appropriate seat at the table.

This is why we have decided not to provide

additional resources to the IMF for the Eurozone.